isvolga.ru

Gainers & Losers

How Do I Put A Credit Freeze On My Accounts

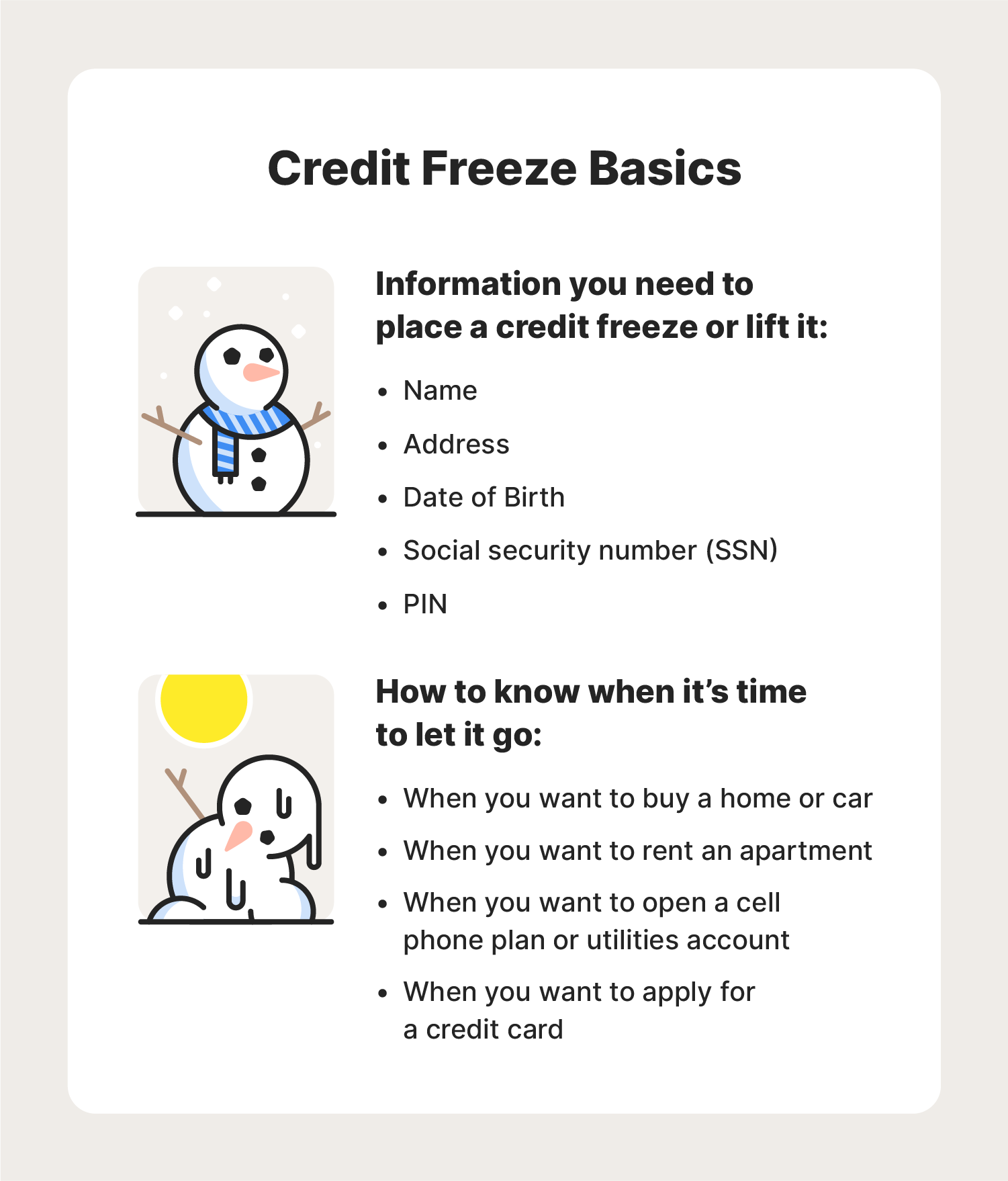

It's free and lasts 7 years. Place when you're on active military duty. It makes it harder for someone to open a new credit account in your name and removes. How Do I “Thaw” My Credit Account? · Call each credit bureau and provide your PIN to unfreeze your credit files. · Apply for the loan and wait until you're. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. A credit freeze, also known as a security freeze, is the best way to help prevent new accounts from being opened in your name. You may do so by contacting. As of September 21, credit freezes are free for residents in all 50 states. Previously, the cost of freezing and unfreezing your credit varied from $0 to. A credit freeze locks your credit report until you approve its release—making it harder for identity thieves to open new credit accounts in your name. To place a freeze, you must write to each of the three credit reporting agencies. You must provide identifying information. If you are an identity theft victim. How to place a credit freeze · Your full name (including middle initial as well as Jr., Sr., II, III, etc.) · Social Security number · Date of birth · Addresses. To place a freeze by phone, call each of the three credit bureaus. Be prepared to supply the information listed above including your driver's license number and. It's free and lasts 7 years. Place when you're on active military duty. It makes it harder for someone to open a new credit account in your name and removes. How Do I “Thaw” My Credit Account? · Call each credit bureau and provide your PIN to unfreeze your credit files. · Apply for the loan and wait until you're. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. A credit freeze, also known as a security freeze, is the best way to help prevent new accounts from being opened in your name. You may do so by contacting. As of September 21, credit freezes are free for residents in all 50 states. Previously, the cost of freezing and unfreezing your credit varied from $0 to. A credit freeze locks your credit report until you approve its release—making it harder for identity thieves to open new credit accounts in your name. To place a freeze, you must write to each of the three credit reporting agencies. You must provide identifying information. If you are an identity theft victim. How to place a credit freeze · Your full name (including middle initial as well as Jr., Sr., II, III, etc.) · Social Security number · Date of birth · Addresses. To place a freeze by phone, call each of the three credit bureaus. Be prepared to supply the information listed above including your driver's license number and.

Like everyone said it's pretty straightforward, you don't need any apps if you don't want them, just create accounts on their websites and. A credit freeze stops a creditor from accessing your credit report to open a new account, even though they have permissible purpose. But if the permissible. You have two primary options for freezing your credit files with the three major credit bureaus. You can do it by phone or online, whichever you're more. Third parties that still have access to your Innovis Credit Report when a Security Freeze is in place include: Companies that have current accounts or. Learn how to freeze your credit for free with TransUnion. Also known as a security freeze, it can help prevent new accounts from being opened in your name. Like everyone said it's pretty straightforward, you don't need any apps if you don't want them, just create accounts on their websites and. 1. Place a security freeze on each of your credit reports (Equifax, Experian, and TransUnion) to stop fraudulent accounts from being opened by the identity. You no longer need a PIN to manage your credit freeze with Experian. All you need is a free Experian account to manage your freeze. How can I freeze a protected. Can I open new credit accounts if my files are frozen? Yes. You can have a Dear Equifax: I would like to place a security freeze on my credit file. You will need to request a freeze with each of the three credit reporting companies. It is important to know that if you place a security freeze on your credit. Credit freezes aren't just for adults. In some cases, you may also be able to freeze accounts on behalf of your children or other adults you're responsible for. To place a security freeze on your Equifax credit report, create a myEquifax account. You can view the status of your security freeze, and also temporarily. How to freeze your credit. All three credit bureaus – Equifax, TransUnion, and Experian – offer the free credit freezes. Yet, placing a credit freeze at one. To place a freeze on your credit you need to contact the credit bureaus to request the freeze. It's important to know that there are THREE national credit. You can place a credit freeze with TransUnion online, or over the phone by calling There's an automated phone system or you can opt to speak to. To place a freeze, either use each credit agency's online process or send a letter by certified mail to each of the three credit agencies. Make sure you freeze. There is no cost to freeze or unfreeze your credit report. How to turn on the Credit Freeze: Contact each of the three major credit bureaus indicating your wish. Unfreezing credit through Experian™, Equifax® or TransUnion ; Online: Experian™ doesn't require you to create an account to lift a credit freeze. Simply fill out. To place a freeze, you must contact each of the three credit bureaus. You can request the freeze by mail. See the sample letters at the end of this sheet for. When you put a credit freeze (sometimes called a security freeze) in place, new creditors can't review your credit reports to judge whether you're eligible for.

Best Investments In Ghana

Real Estate and Agriculture are good sectors to invest in. With growing population around the world there will be a growing need for shelter. Best Investment Bank Awards. Global Sector Award - Best Investment Bank in Power/Energy. African Region Award - Best Equity Bank. Bonds, Loans & Sukuk Africa. The country has developed into an established business destination for investors seeking a conducive business environment, committed and progressive government-. Discover the leading banks in Ghana including Barclays Bank, Ecobank, and Standard Chartered Bank. Find a bank that suits your financial needs today! These accounts provide high, above-market rates and are a good option for long-term strategic growth. Call 00 (Ghana only). or + (All. People ; Photo of Felix Darko. Felix Darko · MEST Express accelerator. Program Manager ; Matthew Boadu Adjei Adjei · Oasis Capital Logo. Oasis Capital. CEO &. Ghana has consistently attracted considerable investment from overseas and has maintained a good history of trade with the rest of the world. This guide has. Ghana's top investing economies include South Africa, the Netherlands, France, Mauritius, and China, according to the IMF. In the first half of , Ghana. At Standard Chartered Bank Ghana, we offer solutions for those seeking investment options beyond the usual bank deposits and help you make the right. Real Estate and Agriculture are good sectors to invest in. With growing population around the world there will be a growing need for shelter. Best Investment Bank Awards. Global Sector Award - Best Investment Bank in Power/Energy. African Region Award - Best Equity Bank. Bonds, Loans & Sukuk Africa. The country has developed into an established business destination for investors seeking a conducive business environment, committed and progressive government-. Discover the leading banks in Ghana including Barclays Bank, Ecobank, and Standard Chartered Bank. Find a bank that suits your financial needs today! These accounts provide high, above-market rates and are a good option for long-term strategic growth. Call 00 (Ghana only). or + (All. People ; Photo of Felix Darko. Felix Darko · MEST Express accelerator. Program Manager ; Matthew Boadu Adjei Adjei · Oasis Capital Logo. Oasis Capital. CEO &. Ghana has consistently attracted considerable investment from overseas and has maintained a good history of trade with the rest of the world. This guide has. Ghana's top investing economies include South Africa, the Netherlands, France, Mauritius, and China, according to the IMF. In the first half of , Ghana. At Standard Chartered Bank Ghana, we offer solutions for those seeking investment options beyond the usual bank deposits and help you make the right.

The country has established seven special economic zones, providing investors with various attractive incentives and benefits. Abundant Opportunities. Ghana. Ghana´s strengths in terms of attracting FDI lie mainly in natural resources. Yet there was also potential to encourage wider investment in non-traditional. Top Ghana- and Africa- Focused Tech Blogs and News Sites Thus, it is central that the start-ups evaluate the impact of their work and the best suitable. shares in top American companies like Google, Apple, and Microsoft? Let me introduce you to Bamboo, the investment app by Africans, for Africans. Most companies or individuals considering investing in Ghana or trading with Ghanaian The Ghana Club is a ranking of the top performing companies, as. Top 10 Brokers in Ghana by BrokerChooser: · Interactive Brokers is the best online broker and trading platform in · XTB - Commission-free stocks and ETFs . Help you invest into the best performing investment funds in Africa. Investors in Ghana. We have SIX possible steps and great isvolga.ru option 4 actually. In this article, I will share the best six online investment apps in Ghana to help you unlock your financial wealth in Achieve is the best investment app in Ghana. We provide you with safe investment products to help you achieve your financial goals. Quick Look at the Best Stock Brokers in Ghana: · Best for Large Transactions: IC Securities Ghana · Best for Retail Investors: SDC Group · Best for Asset. 5 Top Investment Opportunities In Ghana · Here's a look at some of the best opportunities the west African country has to offer: · Telecommunications. Tourism is another sector with potential for investment, as Ghana's diverse culture, history, and natural beauty attract visitors from all over the world. The. This is a marketplace where players buy and sell bonds. The bond market in Ghana is established by key stakeholders in the financial market led by the Bank of. You can invest in mutual funds from as low as USD/GBP/EUR or its cedi equivalent as lumpsum or a minimum of USD/GBP/EUR through a monthly. Great Seal of the United States Message for U.S. Citizens: U.S. Passport Fee Increase Ghanaian investment to the United States is growing – including recent. Currently, Ghana is the number one (1) gold producer, number three (3) manganese producer and number three (3) bauxite producer in Africa. Besides these. Top Ranked Mutual Funds ; Balanced Funds · Databank Balanced Fund Limited · , +%, +% ; Equity Funds · Databank Epack Investment Fund Limited · , +. The Ecobank TBILL4ALL is a mobile-money based investment service that allows Ghanaians to purchase and manage Government of Ghana Treasury Bills from their. If you want to put your money in investment instruments with the best interest rates, you should consider operating a savings account or investing your money in. Capital guaranteed. Know that your deposits will never be at risk of loss. See which account best suits you Stanbic Bank Ghana Limited is a financial services.

Typical Loan Apr

:max_bytes(150000):strip_icc()/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png)

Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ In this guide · Under £3, from % APR · £3, – £4, from % APR · £5, – £7, from % APR · £7, – £15, from % APR · £15, – £20, What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. What is your total loan debt? $ ; How long do you want to take to repay your loan debt? Average is months or years. months ; What is the interest rate? The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Loan Rates ; $1, minimum loan amount, $7, minimum loan amount, $15, minimum loan amount ; %, %, %. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Personal loan APRs typically run from 4% to 36%, but the average rate depends on the loan length and amount, as well as the applicant's credit score, income. Avoid loans with APRs higher than 10% (if possible) According to Rachel Sanborn Lawrence, advisory services director and certified financial planner at. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ In this guide · Under £3, from % APR · £3, – £4, from % APR · £5, – £7, from % APR · £7, – £15, from % APR · £15, – £20, What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. What is your total loan debt? $ ; How long do you want to take to repay your loan debt? Average is months or years. months ; What is the interest rate? The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Loan Rates ; $1, minimum loan amount, $7, minimum loan amount, $15, minimum loan amount ; %, %, %. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Personal loan APRs typically run from 4% to 36%, but the average rate depends on the loan length and amount, as well as the applicant's credit score, income. Avoid loans with APRs higher than 10% (if possible) According to Rachel Sanborn Lawrence, advisory services director and certified financial planner at.

interest rate and a representative APR. It's the typical – or representative – rate for the majority of borrowers. Lenders only have to give that rate (or a. Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, discount points and loan origination fees. APR can help you compare lending products, such as loans or credit cards, on a like-for-like basis. If you search for a loan, say on a price-comparison site. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The average APR for a car loan for a new car for someone with excellent credit is percent. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. Sample APRs include typical finance charges, such as lender fees and other charges paid to get the loan. The average personal loan interest rate is dependent on several factors, including the amount borrowed, credit history, and income, among others. The average credit card interest rate in America today is % — tied for the highest since LendingTree began tracking rates monthly in Average, Sum, End of Period. Customize data: Write a custom formula Consumer Credit Banking Personal Loan Rates Interest Rates Money, Banking, & Finance. interest rates. Get offers from trusted lenders for your situation Loan amount * Estimated average over the life of the loan. Payments may vary. As far as personal loans go, % is generally a pretty great rate and very close to the lowest one can get. Reply. Average personal loan rates* on 3-year loans were at % APR, down from % last week and up from % a year ago. Average personal loan rates* on Everyday low interest rate · Flexible payment schedule and payment options · Access funds at any time via ATM, branch, cheque, online or telephone banking. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Personal loan interest rates today are unusually high, thanks to market forces. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined.

1 2 3 4 5